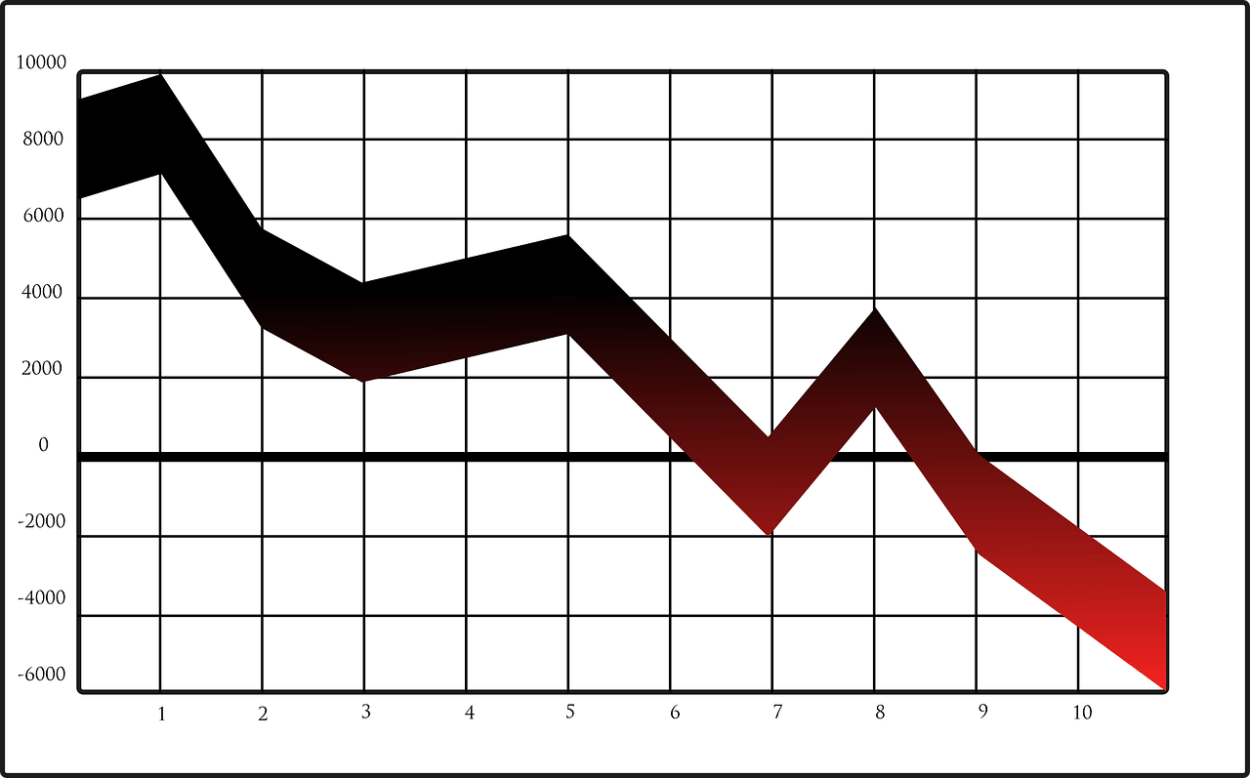

I usually take stock of the crowdfunding industry at the start of every year. The funding portals that are the backbone of the Regulation Crowdfunding (Reg. CF) side of crowdfunding continue to languish. Several of the funding portals have closed their doors this year.

At the same time several of the more vocal, self-promoting crowdfunding “experts” have moved on and re-branded themselves as experts in something else. If there is one pervasive truth about operating a funding portal is that few are making a lot of money.

Very few of the offerings made on funding portals have raised even $1 million. Most companies are walking away with pocket change when they need serious capital. We’re seeing $25,000 raises when companies need ten or even one hundred times that amount. Something’s got to change.

The Regulation D (Reg. D) side of crowdfunding continues to boom. More and more professional sponsors realize that they can raise significant amounts of money without paying stockbrokers to bring investors and without expensive and unnecessary private placement memos.

Changes to Reg. CF in 2021 permit both accredited and non-accredited investors to co-mingle in the same offering. Few offerings seem to take advantage of this fact. Some issuers even run a Reg. D and Reg. CF offering side by side. That is a foolish waste of resources.

Funding portals need to step up their game. This is what they should be telling companies that seek to use their portal to raise capital.

A Successful Raise Requires Professional Help

The worst mistake any company can make is trying to successfully raise capital without professional help. A company needs a CPA to present financials and prepare projections, someone with a background in finance to help structure the offering and a marketing company with experience in raising capital. Every funding portal should be ready to make referrals to professionals who will get the job done.

There is No Free Lunch in the Capital Market

Every company raising capital needs an adequate budget. The professionals mentioned above expect to get paid. The funding portal will likely have an on-boarding fee. I always tell any company raising capital to budget a little more than they expect to spend. Nothing kills a fundraising campaign like running out of money to spend on it.

What Really Works in Private Markets

Think about successful Reg. D offerings for a minute. They typically offer passive income through revenue sharing – something crowdfunding portals rarely do. Real estate and oil & gas deals have been doing this forever, and guess what? It works.

Revenue sharing arrangements are often structured to be “above the line and off balance sheet” making them ideal for startups and many small businesses. Notwithstanding, few of the offerings I have seen funding portals adopt this financial model.

The Truth About SAFEs (And Why They’re Not So Safe)

Here’s something that might ruffle some feathers: Those SAFE agreements everyone loves? They’re popular because they’re free to create, not because they’re good. They’re basically derivatives that most investors don’t understand, offering higher risk without better rewards.

Let’s Talk About Minimum Investments

Want to know why many offerings struggle? They’re chasing $100 investments when they should be targeting $2,500 minimums. Do the math: To raise $1 million with $250 minimums, you may need to reach 40,000 potential investors. With $2,500 minimums? Just 4,000.

Aggressively seeking accredited and mid-level investors to invest more than the minimum amount further reduces the number of investors needed. That can be the difference between an affordable and an out of reach marketing expense.

The Marketing Myth That Needs to Die

Remember when everyone said companies would get funded by their “community”? That’s a fairy tale created to make underfunded companies feel better. Real fundraising requires professional, data-driven digital marketing campaigns. It’s a numbers game, and you need experts who understand the difference between selling products and selling investments.

Learn to Just Say No

Funding portals should not try to fund companies that have no chance of success. FINRA cautions that funding portals should not list companies with impractical business plans. Portals should not hide behind the maxim that 90% of startups and small businesses fail anyway. Investors want to invest in winners.

In many cases the problem is not the business plan but the founders. When I run across an inexperienced founder or business owner I send them to SCORE or a similar program that will help them bring competent advisors on board.

I am always surprised when I find a funding portal that does not have a good relationship with one or more business accelerators or mentorship programs. Most accelerators would benefit from a relationship with a funding portal that could fund their graduates.

Getting Real About Numbers

Valuations ascribed to many of the issuers are pure fantasy. Worse, there have been persistent rumors that valuations can be bought and paid for. There is no need to create a valuation for any offering. Other than real estate appraisals, valuations should be eliminated across the board.

Investors want to know how their money will be spent, how many sales the funds they are supplying will generate. Projecting future sales and costs is not always easy but claiming that the company will capture “1% of the customers in China” just does not cut it.

Investors expect that a company seeking capital have a reasonable idea of the costs of customer acquisition, employee costs including taxes and benefits and has a marketing budget based upon real proposals. Companies that don’t have a good idea of their sales and expenses are not likely to succeed.

Due Diligence is an Integral Part of Every Offering

A thorough due diligence investigation can be expensive and few funding portals seem to have the ability to conduct one in house. Still, sooner or later, a funding portal that does not investigate every offering is going to make some class action lawyer very happy.

It would be a great idea if the Crowdfunding Professionals Association (CfPA) kept a library of those companies and individuals who tried to game the system. Over time it would protect investors from loss and CfPA members from liability.

The Bottom Line

Crowdfunding in 2025 needs funding portals to evolve from passive listing services into active capital formation partners. That means providing real value – helping structure offerings, verifying claims, and actively supporting fundraising efforts. The SEC gave us expanded investment limits in 2021 – it’s time we used them properly. Remember, we’re not just listing offerings – we’re building a sustainable funding ecosystem for the next generation of businesses. Let’s start acting like it.

If you’d like to discuss this article or anything related, then please contact me directly HERE

Or you can book a time to talk with me HERE